Essence of Enterprise - The Tech Workout

The tech industry is associated with huge highs and lows and of journeys from “garage start-ups” to global behemoths. This creates a certain sense of glamour for this sector, but the reality for most tech entrepreneurs is much grittier.

Why being on the cutting edge requires grit and determination

To start with, tech founders set themselves ambitious growth targets. Based on our most recent research, they aim for 20 per cent turnover growth per year, 2 per cent above the average for start-ups, and they are starting from a base USD400,000 higher than the cross-sector average.

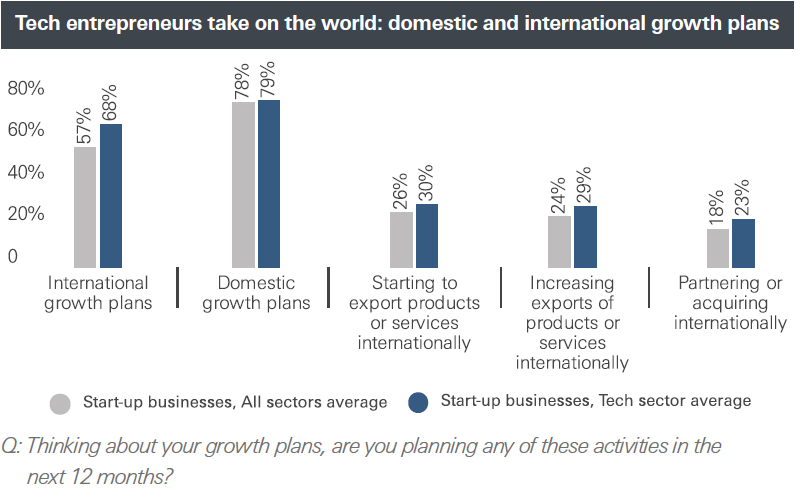

The race to be one step ahead of competition also forces tech entrepreneurs to expand their ventures rapidly on multiple fronts, and often simultaneously at home and abroad. Right from the start-up phase, tech entrepreneurs are 10 per cent more likely to push for rapid international expansion than founders from other industries.

This takes time and energy, meaning that tech entrepreneurs tend to work the longest hours of any sector. Their average working day is longer than 10 hours. They do not dramatically cut down on their sleep, but rather they compromise on their personal life and tend to spend less time relaxing and socialising.

In fact, our research shows that tech entrepreneurs are particularly prone to losing motivation in the start-up phase of their ventures – 10 per cent more when compared with other sectors.

The ambitious targets of tech entrepreneurs also create a high-pressure environment and the fast pace of change in the tech industry leaves many entrepreneurs facing a significant growth challenge. One in three tech entrepreneurs worries about keeping pace with technological innovation compared to one in five in other industries.

One entrepreneur who understands how to deal with these challenges is Douglas Orr, founder of Fintech business Novastone, his third successful technology business. Mr Orr’s first venture was a self-funded data storage business based in Norway that he sold in 2001, having battled through the dot-com crash in the late 1990s. He founded and was an investor in the second successful venture, before founding Novastone in London in 2014.

Serving leading international businesses, Mr. Orr’s vision for Novastone is a global one. This can be a challenge in the UK, where venture capitalists tend to seek out “local heroes”.

It is even more challenging in the Fintech sector, he explains. “We serve established high-end businesses in the financial and legal sector, where the sales cycle is relatively long. It requires patient funding.”

He explains that many UK venture capital firms are wary of international ventures, which leaves angel investors to fill the gap. These angels have often created their wealth in financial services or property, not in the technology industry, which means they too are often cautious about the tech sector’s global growth ambitions.

He likens the challenge of being a Fintech start-up to being a “small ship in a big ocean”.

“To be successful in the tech industry it is simply not enough to aim to become the next ‘local hero’ you need to become ‘a global hero’,” he says.

The second challenge he highlights is the difficulty finding a network that can help to access funding and provide the support and connections to help the business to grow.

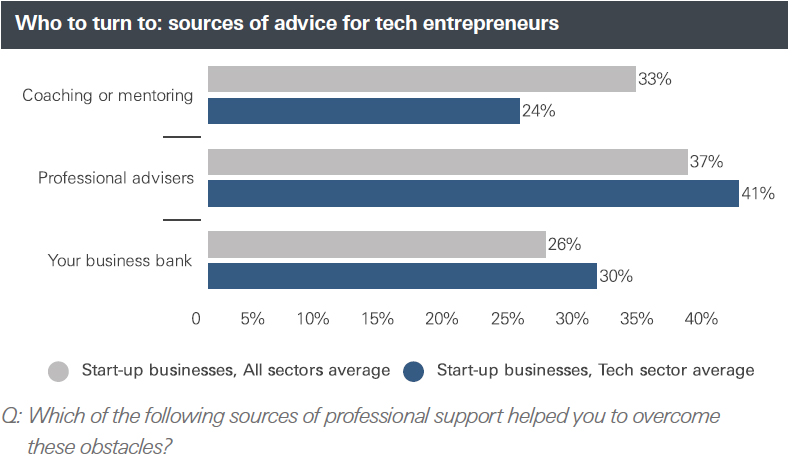

In fact, our research shows that tech entrepreneurs are almost 10 per cent less likely to be able to access coaching and mentoring than start-ups in other industries.

Mr Orr’s advice for start-up tech entrepreneurs is therefore to seek out angel investors who have experience in the tech sector and can support your growth ambitions.

“I have been fortunate to find tremendous angel investors who really understand the tech industry,” he says. “They understand the funding cycle and they can open doors.”

Mr Orr adds that they provided a crucial sounding board that helped his idea to work and take off. In the fast paced tech sector, success is all about having the right strategy at the right time, he explains.

You need to embrace your failures quickly: you have to fail fast. Having good mentors is a way of learning faster, which will take you more quickly to where you will be successful.

It also requires perseverance.

A keen runner himself, Mr Orr compares growing a tech business to running a race. “If you persevere, you are still in the race – you might be in the wrong race with the wrong strategy, but it is perseverance that will help you to get the right race plan.”

Comparing the UK to Silicon Valley, Mr Orr highlights that London is a great place to grow an international business. Many talented young developers have been drawn to the city and have brought a strong entrepreneurial spirit with them.

However, the network of experienced technology entrepreneurs is still relatively thin in the UK. This, he believes, is the biggest single factor that makes building a technology business particularly challenging.

“We have a few really successful tech entrepreneurs in the UK, but we need a hundred of them. We are still very much breaking down barriers and I don’t know how many years or decades it will be before we have the strong network of mentors we need to support funding, growth and exports.”